The Martini Mortgage Group which has its headquarters in Raleigh publishes every month the Raleigh, NC (Wake County) Real Estate Report Card and this is the April 2022 edition. The key metrics applied are Median Home Price, Appreciation, Population, and Affordability.

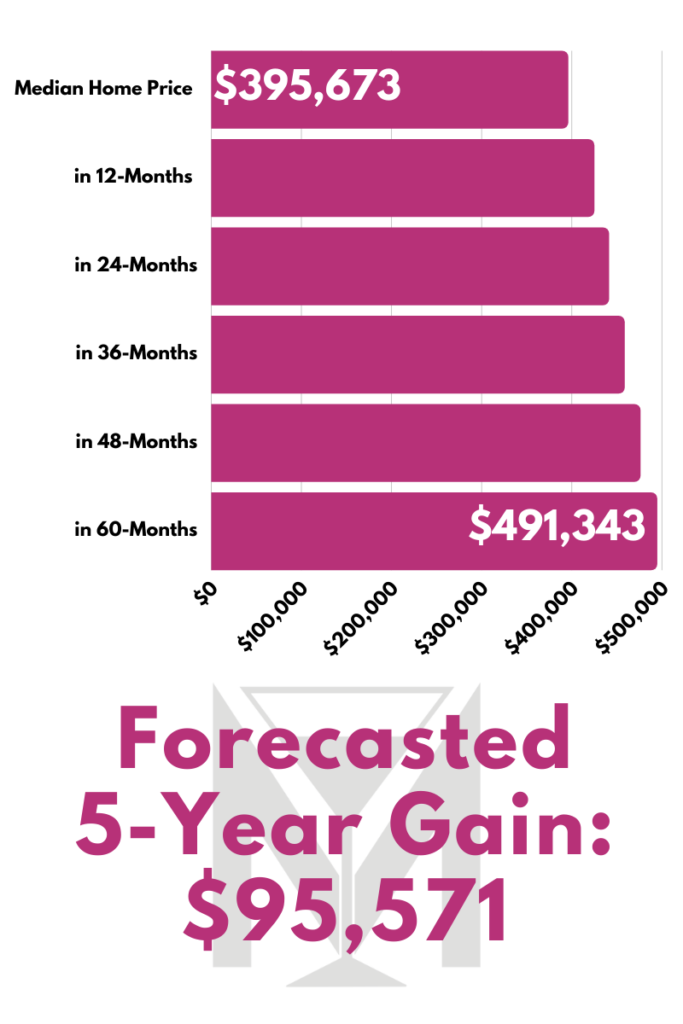

Median Home Price

A key indicator for market trends and market conditions is the Median Home Price. Simply put, the Median Home Price is the middle price point for real estate prices and it is not the same as Average Home Price.

The Median Home Price is my preferred metric because it is less impacted by a few atypical high or low sales in the Raleigh market.

Certified Mortgage Advisor, Kevin Martini

Wake County, North Carolina Median Home Price

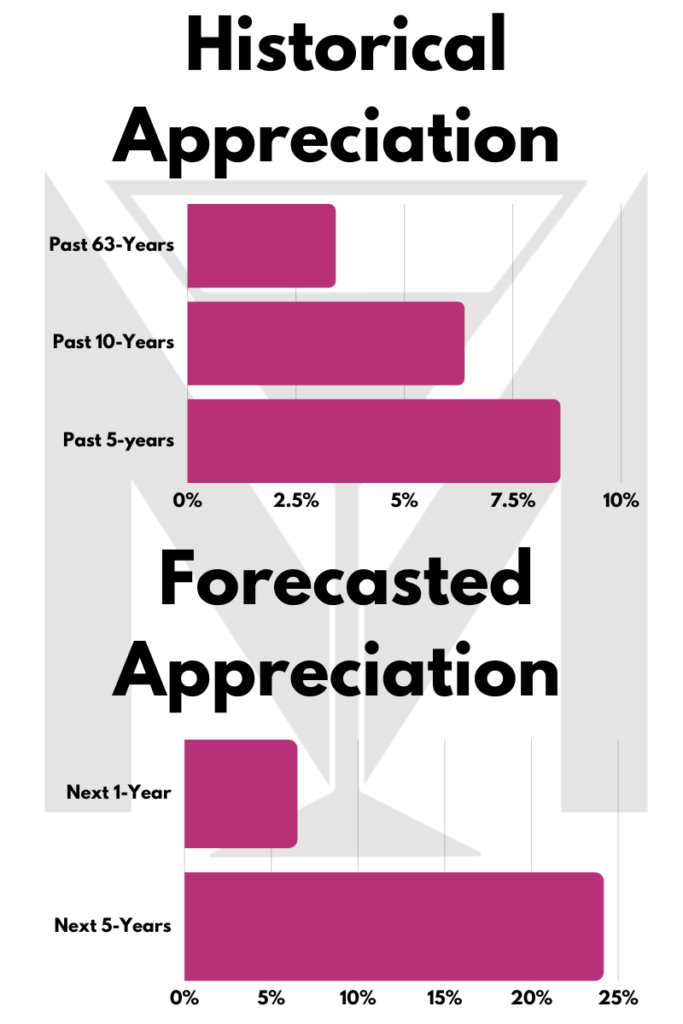

Appreciation

In the April 2022 Real Estate Report Card, the Martini Mortgage Group looks at historical appreciation and forecasted appreciation based on from leading industry experts. Important to note, appreciation is just a forecast and not a guarantee of future performance.

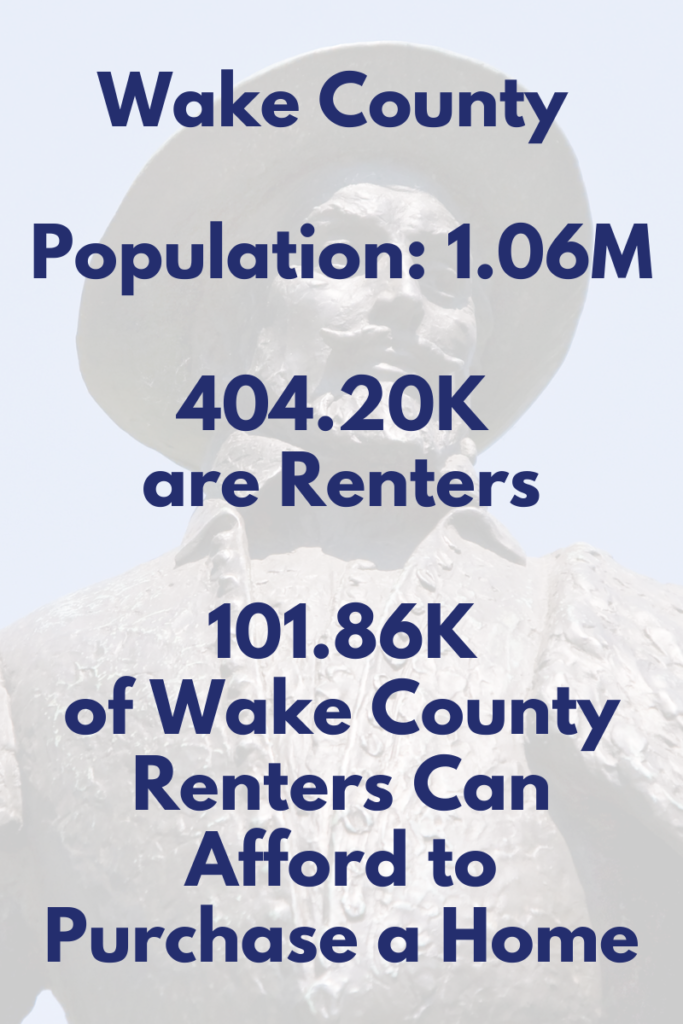

Population

1 million plus (1.06M) call Wake County, North Carolina home and it is one of the fastest growing counties in North Carolina. In addition, it is the largest county in North Carolina with a 25% growth rate. Daily growth is 60+ people per day.

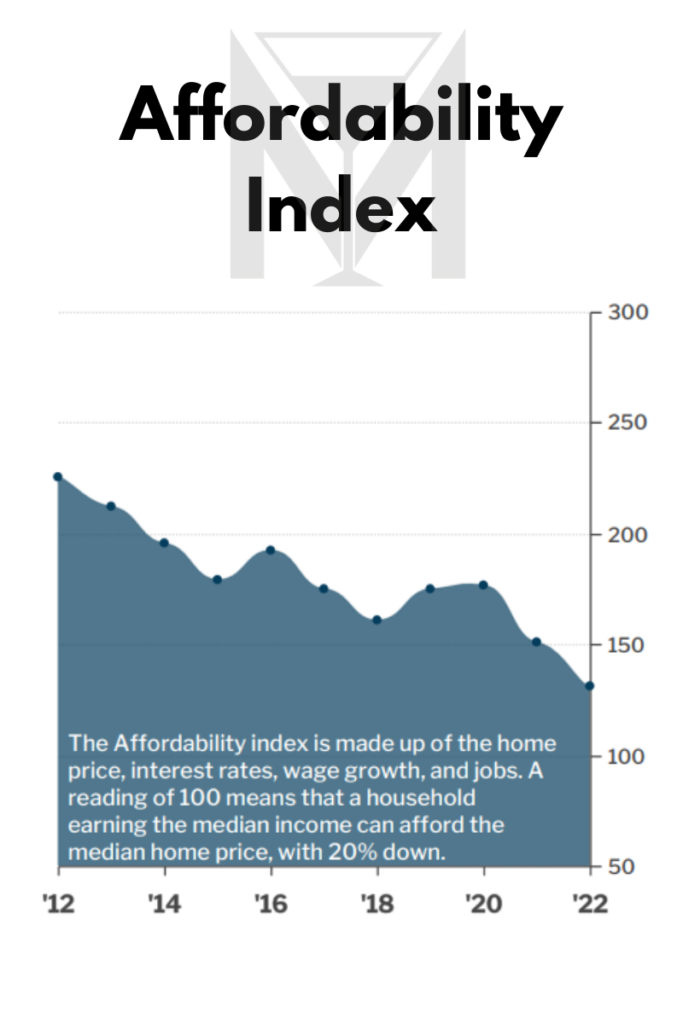

AFFORDABILITY

Oh By The Way

It is never too early to start to explore your homeownership options and you are not too late either. The first part of the homeownership journey is the loan and then after you have the certainty and being armed with price and cost clarity, the second step is to go find your home. The Martini Mortgage Group offers trusted advice with a frictionless digital mortgage process that provides certainty. To contact a Mortgage Strategist with the Martini Mortgage Group simply call: (919) 238-4934.

Martini Mortgage Podcast

Homeownership has so much to offer financially but it can also positively impact your life today and impacts future generations. In this special episode Certified Mortgage Advisor , Kevin Martini, share 6 Financial Benefits for Homeownership. Each benefit is powerful by itself but when you consider the layers of benefits to homeownership, it is an opportunity that needs further investigation if it is right for you and your family.

The 6 benefits that are explained in detail in episode 135 of the Martini Mortgage Podcast are: Leverage, Housing Cost, Forced Savings, Tax Benefits, Hedge Against Inflation and Non-Financial Benefits.

Listen to the full episode and to learn more or to learn how homeownership can help you, connect with Kevin Martini with the Martini Mortgage Group by calling (919) 238-4934.