The 2023 conforming loan limits for the Raleigh, North Carolina and the Triangle of North Carolina by the Federal Housing Finance Agency (FHFA) have been established. 2023 will bring a $79,000 increase in conforming loan limits for a one-unit property in Raleigh, North Carolina and surrounding areas. The new 2023 conforming loan limit is $726,200.

Higher conforming loan limits benefit both a homebuyers and homeowners too! For a homebuyers, it opens more price points with lower down payments For homeowners, they can access more equity.

Kevin Martini

Raleigh Mortgage Broker & Certified Mortgage AdvisorBenefits from the 2023 Loan Limit Increase

BUY A HOME

It may make sense for you to consider a new home purchase using the higher loan amounts. This may be the perfect time for you to lock in your interest rate before interest rates move higher.

REFINANCE

It may be worth it to consider a home loan refinance if:

- You currently have a home loan that is near the loan limit

- You’d like to make some home improvements

- You’d like to consolidate other debts into your home loan (such as home equity loans or credit cards)

- You’re paying mortgage insurance and your home has increased in value from the time when you purchased the home

- You anticipate a change in your cash flow situation in the coming months (college funding, retirement, elder care, etc.)

Raleigh, NC 2023 Conforming Loan Limits

One-Unit

Two-Unit

Three-Unit

Four-Unit

$726,200

$929,850

$1,123,900

$1,396,800

All cities and towns in Wake County to include Raleigh and Apex, Garner, Fuquay-Varina, Holly Springs, Knightdale, Morrisville, Roseville, Wendell, Zebulon.

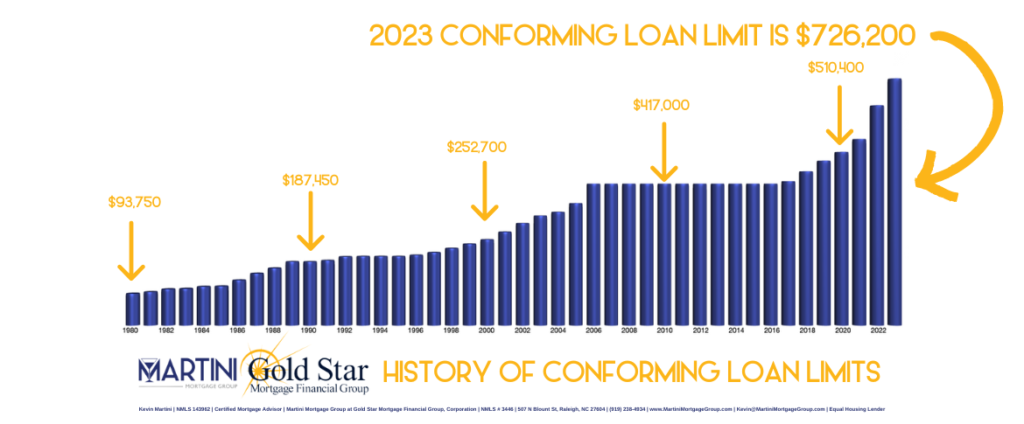

History of Conforming Loan Limits in Raleigh

What are conforming loan limits?

Fannie Mae (a.k.a. Federal National Mortgage Association or FNMA) and Freddie Mac (a.k.a. Federal Home Loan Mortgage Corporation or FMCC) were created by Congress to provide liquidity, stability and affordability to the mortgage markets. Both Fannie Mae and Freddie Mac are government-sponsored entities not lenders instead, they offer access to funds and guarantees.

Loans guaranteed by Fannie Mae or Fredie Mac are commonly referred to as conforming loans since they conform to the Fannie Mae and Freddie Mac guidelines. Conforming loans are also referred to as agency or conventional loans.

Housing and Economic Recovery Act (HERA)

In response to events of 2008, HERA was a piece of legislation that requires a baseline conforming loan limit to be adjusted annually to properly reflect the changes in average home prices using data from the last four quarters from the FHFA House Price Index (a.k.a.FHFA HPI).

According to the most recent FHFA HPI, home price rose on average 12.4% from the third quarter of 2021 to the third quarter of 2022. In North Carolina, home prices rose 17.4%. The Raleigh – Cary metro area had a 16.7% year-over-year change and is ranked #18 of 100 top metros.

Be ready to make you move

Let’s connect so you can understand how higher conforming loan limits can help you and your family.