What is a Buydown?

A buydown (a.k.a. ‘Seller-Paid Buydown‘ or a ‘Temporary Buydown’) is where the seller pays a fee at the closing to reduce the interest rate on the homebuyer’s mortgage temporarily. This results in temporarily lowering the buyer’s monthly payment and making the home more affordable for a homebuyer today.

What is a 2-1 Buydown?

A 2-1 Buydown is when a seller pays a fee at closing (the fee must be within the Interested Parties Contribution based on the loan the homebuyer is securing) reducing the interest rate on the buyer’s mortgage by 2% in year 1 and 1% in year 2.

How does a Temporary Buydown work?

At the time of closing, the seller will fund a custodial escrow account on behalf of the new homeowner. The borrower will have a reduced monthly payment, and the difference in interest rates comes out of the custodial escrow account.

If at the time of sale or refinance, there is a remaining balance in the custodial escrow account, the unused balance will be credited to the borrower.

Advantages of a Buydown for a Raleigh Homebuyer

A buydown reduces the buyer’s mortgage interest rate and monthly payment during the first few year(s) of homeownership, making the home more affordable for homebuyers. Buydowns have a much greater impact on the homebuyer’s monthly payment than reducing the list price of the home.

Advantages of a Buydown for a Raleigh Home Seller

A buydown could be a great negotiating tool because a greater percentage of homes listed for sale in today’s market are seeing price reductions. Not only does a buydown make a home more affordable to a wider range of buyers who may have otherwise been priced out of the market, it also tends to cost less than a price reduction.

A seller offering to pay for a buydown could provide a competitive advantage vs. other homes listed for sale in today’s changing market. This is because rising Raleigh interest rates could create significantly an affordability challenge for many potential buyers.

As an added benefit, a buydown could also save a seller the aggravation and financial loss of having to significantly reduce your list price in order to compete with other homes that may be listed for a lower price.

In today’s market both seller and buyers need to evaluate the best approach.

Logan Martini | Raleigh Mortgage Broker & Certified Mortgage Advisor

A 2-1 Buydown Scenario

For illustration ONLY: if a homebuyer purchased $400,000 home and put 20% down with a 30-year fixed rate of 7%, they would have a P&I payment of $2,129. However, if the homebuyer requested (or the seller offered) at the list price (e.g. $400,000) the Martini Mortgage Group 2-1 Buydown Program, the rate would be reduced by 2% for the first year (i.e. 5% in this example for illustration ONLY). The rate would be reduced by 1% for the second year. The homebuyer would save $4,932 of P&I during the first year and that is a savings of $411 a month to the homebuyer. In the second year, the homebuyer would save $2,520 a year and that is a savings of $210 a month to the homebuyer.

Is a 2-1 Buydown The ONLY Buydown Option?

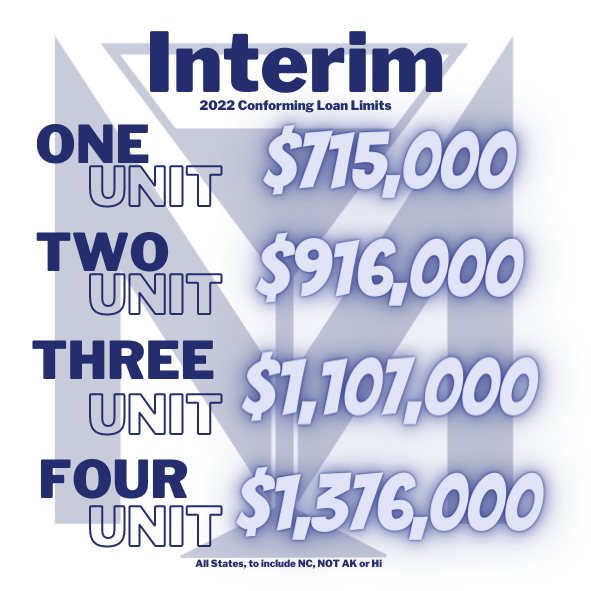

No, the Martini Mortgage Group, a Raleigh mortgage lender, Buydown Program has three options (i.e. 1-0 Buydown, 2-1 Buydown & 3-2-1 Buydown). Let’s connect so you can get trusted advice from a local expert that some call the best mortgage guys in Raleigh, NC. The Martini Mortgage Group offers local home loan programs such as Conventional Loans, FHA Loans, Jumbo Loans, and USDA Loans to name a few.

To contact loan officer Logan Martini for a financial review simply call (919)238-4934 or stop by the office since the Martini Mortgage Group is local and is located in downtown Raleigh, NC at 507 N Blount St, Raleigh, NC 27604.