In Raleigh, North Carolina, as in the rest of the state, the allure of homeownership extends far beyond the emotional satisfaction of having a place to call your own. A critical yet often overlooked aspect of this investment is the potential tax savings. Yes, when considering a Raleigh mortgage, it’s not just the apparent rate you need to consider, but the actual cost after tax benefits. This is where Raleigh mortgage broker Logan Martini and the Martini Mortgage Group step in, providing invaluable insights into understanding the real cost of your mortgage, factoring in these tax advantages.

The Hidden Financial Perk in Your Raleigh Mortgage

A common misconception among many Raleigh homebuyers is that the cost of borrowing is directly tied to their mortgage rate. However, when tax deductions come into play, the scenario changes significantly. The IRS allows homeowners who itemize deductions to write off the interest on mortgages up to $750,000 (see IRS Publication 936, Home Mortgage Interest Deduction). This provision can substantially reduce your effective borrowing costs.

The Logan Martini 3-Step Process on How to Calculate the After-Tax Interest Rate on a Raleigh Mortgage

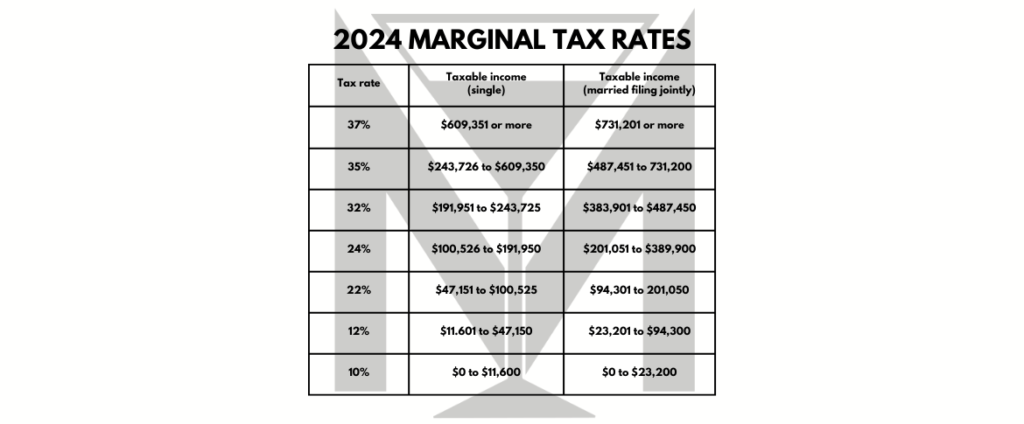

Homeowners who itemize tax deductions can deduct the interest on up to $750,000 of mortgage balances used to buy, build, or improve a qualified home. To calculate the after-tax cost of your mortgage there are 2 things you will need; what is your marginal tax bracket based on how you file (i.e, Single filer or Married, filing jointly), and what is your current mortgage rate for your home or projected Raleigh mortgage rate for your future property.

Step One: Your Marginal Tax Bracket

The first step is to determine your marginal tax bracket based on how you file. A marginal tax rate is the rate that applies to the last dollar of your taxable income. In other words, the highest bracket homebuyer’s income falls into. At the time of publication, there are seven federal income tax brackets for 2024. The top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Step one to calculate the after-tax interest rate is to determine your marginal tax bracket.

Step Two: Your Mortgage Rate

What is your mortgage rate? Specifically, the note rate of your mortgage, not the Annual Percentage Rate (APR).

Step Three: After-Tax Mortgage Rate

Step three has three steps and will require some very simple math to be performed:

- express your tax bracket as a decimal

- subtract the decimal from the whole number 1

- multiple that number by the note rate of your mortgage or projected mortgage rate

For illustration purposes ONLY, let’s assume you are in a 24% tax bracket and your Raleigh mortgage rate is 6.5%.

First step: Express the tax bracket as decimal … for this example, we are assuming a 24% marginal tax bracket so in a decimal form that is expressed as 0.24

Second step: Subtract the decimal from the whole number one … for this example, we would take one minus the marginal tax bracket expressed as a decimal hence, 1 – 0.24 = 0.76

Third step: Multiple that number by the actual mortgage rate … for this example, we are using a mortgage rate of 6.5% so 6.5 x 0.76 = 4.94

In this example, a 6.5% mortgage costs ONLY 4.94% after-tax for someone in a 24% tax bracket.

TL;DR (Too Long; Didn’t Read) by Logan Martini

Understanding the after-tax cost of your mortgage in Raleigh is vital in realizing the full extent of homeownership’s financial benefits. Logan Martini’s expert guidance can help you navigate this often-overlooked aspect of mortgage planning. By following these simple steps, you can uncover the true cost of your mortgage and potentially save a significant amount of money.

Want Help or to Learn More?

Are you interested in exploring how you can benefit from the after-tax advantages of your mortgage? Contact Raleigh mortgage broker Logan Martini with the Martini Mortgage Group today. Let him guide you through the financial aspects of homeownership and help you maximize your investment.

Logan Martini

PLEASE NOTE: THIS ARTICLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE LEGAL, TAX, OR FINANCIAL ADVICE. PLEASE CONSULT WITH A QUALIFIED TAX ADVISOR FOR SPECIFIC ADVICE PERTAINING TO YOUR SITUATION. FOR MORE INFORMATION ON ANY OF THESE ITEMS, PLEASE REFERENCE IRS PUBLICATION 936. Also, this article is not an offer or commitment to lend you money, and it is not an advertisement for a specific mortgage or a specific interest rate.