A topic that is on the mind of many potential first-time homebuyers and current homeowners in Raleigh, North Carolina and really in every city in the U.S. is, are heading into a housing crash because we are in a housing bubble that is going to burst.

Raleigh Mortgage Broker and Certified Mortgage Lender, Kevin Martini, hosts a very special episode of the Martini Mortgage Podcast called: A Real Estate Crash Coming soon, NOT!

Episode 143 of the Martini Mortgage Podcast goes beyond the real estate headlines and deep into the data.

Home Price Appreciation Since 1945

Forbearance Data

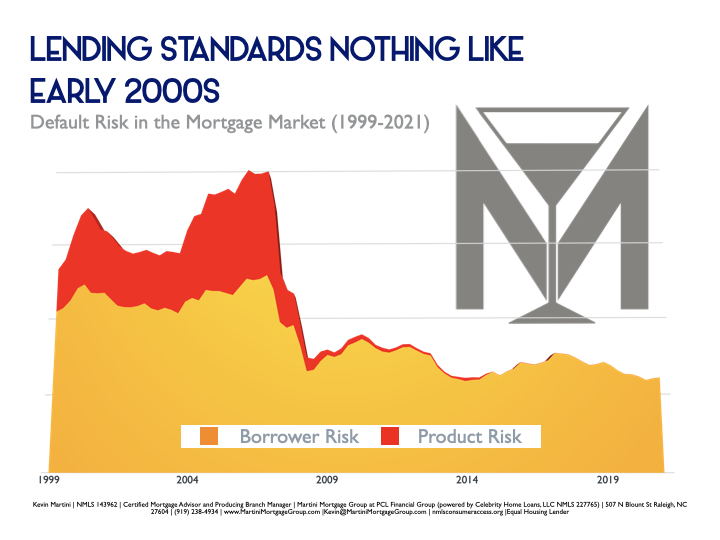

Lending Standards

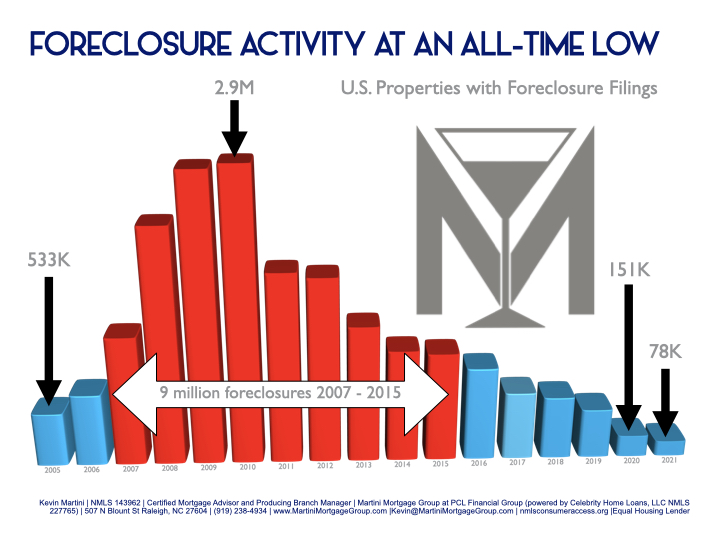

Foreclosure Activity

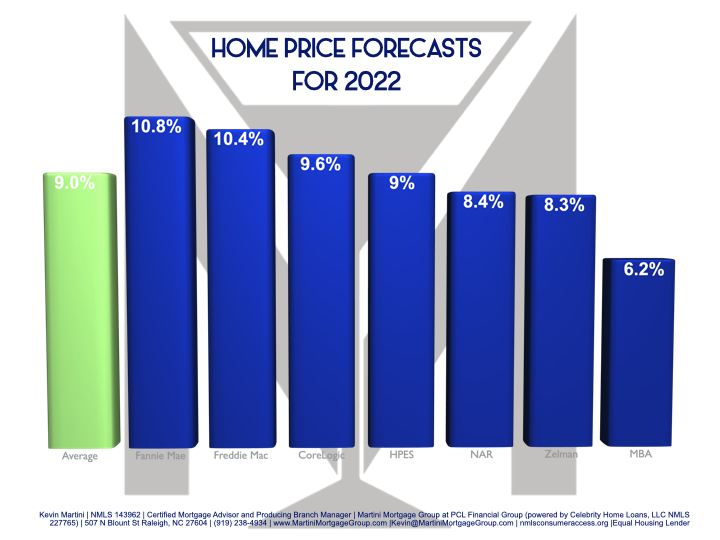

Home Price Forecast for 2022

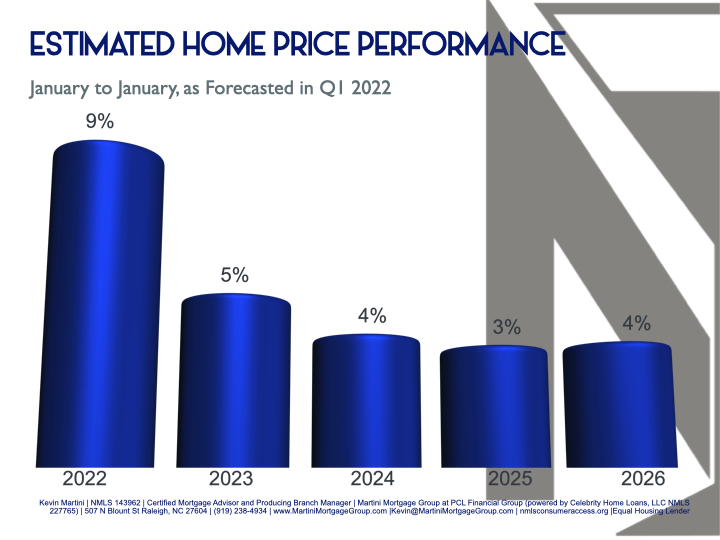

Home Price Expectation Survey | Q1 2022

Episode 143 of the Martini Mortgage Podcast with Kevin Martini Transcript

A topic that is on the mind of many potential first-time homebuyers and current homeowners in Raleigh, North Carolina and really in every city in the U.S. is…are heading into a housing crash because we are in a housing bubble that is going to burst.

I truly understand why many are concerned with the idea we are in a housing bubble and it is going to burst because 15-years ago we saw home prices fall and it was very painful.

Let me properly communicate this…2022 is not 2008!

Welcome to episode 143 of the Martini Mortgage Podcast, my name is Kevin Martini and I am a Certified Mortgage Advisor with the Martini Mortgage Group which is located in Raleigh, North Carolina however myself along with my very talented crew of mortgage professionals help families in all 100 counties of North Carolina and pretty much in ever state in the U.S. too! I am calling this special episode of the Martini Mortgage Podcast; A Real Estate Crash Coming Soon, NOT!

Opinions are like belly buttons, everyone has one. Some opinions are based on what one feels and some opinions are based on data. I believe when you use data to form an opinion it clears the path so one can make an educated decision based on facts. I believe educated decisions puts you ahead of the crowd.

Some folks feel we are in a real estate bubble and this bubble is going to burst and when it burst it is going to cause a housing crash like we saw in 2008. If you feel this way, with respect, you are incorrect. Let me share with you why we are not in a housing bubble and why we are not heading into a housing bubble.

Let me start with when the modern day housing boom started and that was 1945. World War II ended and soldiers were coming back and they were using the earned VA benefit where they could buy a home. Ever since then and up to today…there has ONLY been one time where homes in the U.S. lost a significant value and that was in 2008.

Why did we see homes lose value in 2008?

There were several reasons why homes lost value and they were from pure market speculation to, over supply to, very loose lending standards among other things.

When I say very loose lending standards, I mean back then you could secure a home loan with no income so a job was not required hence there was no verification of employment was even asked for. Think about it, you could buy a home or take money out of your home without really being able to qualify or have the ability to repay the home loan. Simply put, many people that were unable to afford a home were able to buy a home.

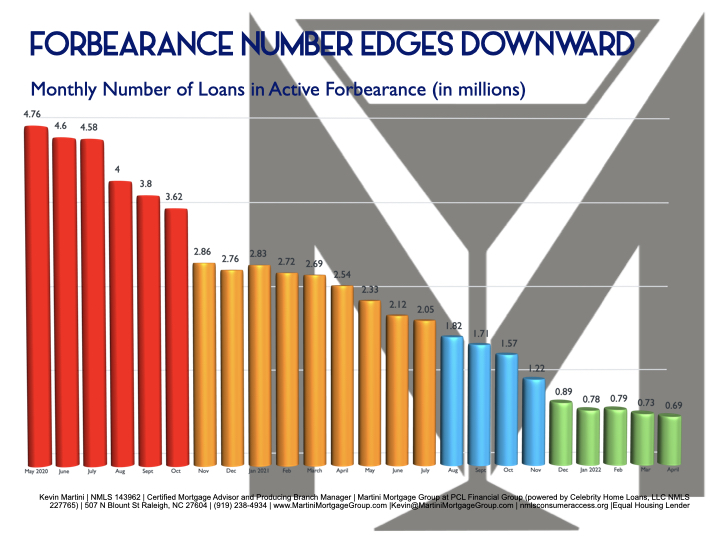

I feel it is natural to be concerned if today people are able to make their mortgage payments. Since the evil pandemic reared its ugly head, many families had to go into forbearance. In the simplest form, forbearance is a loan deferment where one can temporarily stop making payments.

About 4.8 million used forbearance to navigate during the pandemic and today there are less than 700,000 loans in forbearance as of April 2022. The number of mortgages in forbearance has dropped significantly and it is true, not everyone will be able to get out of forbearance successfully however that number is very low but rember this, the families that have not been able to recover are not upside-down on the the home and they have the ability to sell and retain a gain to get on with rebuilding. This is very different than what happened 15-years ago.

Aggressive lending standards were one of the components of the housing crisis, and let’s look at where we are today. Today lending standards are nothing like they were in the 2000s.

Consider home loan product risk and borrower risk. Think of the designer mortgage product risk as the all loans that are available to people such as NINA, which was an acronym for no income no assets or SISA, which was an acronym for stated income stated assets. These designer mortgage products have been virtually eliminated from the marketplace.

Oh by the way, these loan programs were not bad products in my opinion. Crazy statement? Not really, when you know these products had a place for the right borrower based on thier situation but these products were sold by some very bad actors to the the wrong people.

Today when getting a mortgage, there is a common sense approach to your ability to repay the home loan. Has it gotten harder. Well, yes if you compare it to the 2000’s but, common sense is still present with underwriting with the Martini Mortgage Group and I feel that product risk and borrower risk is balanced today.

Don’t believe me? Well, today we are at all time low with foreclosure activity. Sure, the last couple of years there has been a moratorium in place and the federal government has stepped in and said, look, we’re not going to process these foreclosures during the pandemic. However, back during the housing crisis, it was tragic that over nine million people went through foreclosure.

Listen, foreclosure are sadly always going to happen because bad things happen to good people. It is sad but it is a reality. Today with the common sense lending standards that have been deployed has led to less foreclosures in the marketplace pre-pandemic and post pandemic.

In other words, with highly qualified or a better qualified borrower, you’re going to see less defaults and we’re seeing exactly that and provides additional confirmation that the light at the end of the tunnel is not a train coming at us but it is rays of sunshine.

I had a conversation with a family I am working with and they were concerned about a ton of things and I understood and I appreciated their concerns. They felt like you may feel…let us see if that is the case. They felt homes are getting too expensive and people are not going to be able to support their debt load and this would cause a collapse in the housing market.

I understand the thought process but the data does not support the thesis because if you look at data from the Federal Reserve, household debt service ratio for mortgages and basically it measures the percentage of disposal personal income. So, think about the total mortgage payments divided by the total disposal personal income. Make sense?

Where the household debt service ratio is for mortgages right now much much lower than where we were in the housing crisis, even lower than we were in the 80s and 90s. And why is that? Because of rising wages. Because of interest rates that we’ve seen. And because folks that are holding mortgages today are in a much, much better position than where they were back in the housing crisis of ‘08.

So is there a bubble forming or are we in a bubble that is getting ready to burst – NO! No there is not a bubble forming and NO we are not in a bubble that is getting ready to burst. There is not an imminent housing crisis however we are right now in a housing boom!

I believe when we look back at 2022 3 to 5 years from now we will call this period of time the good old days of real estate. In other words, you will be with either be very happy that you purchased a home in 2022 or you will wish you would have purchased a home in 2022.

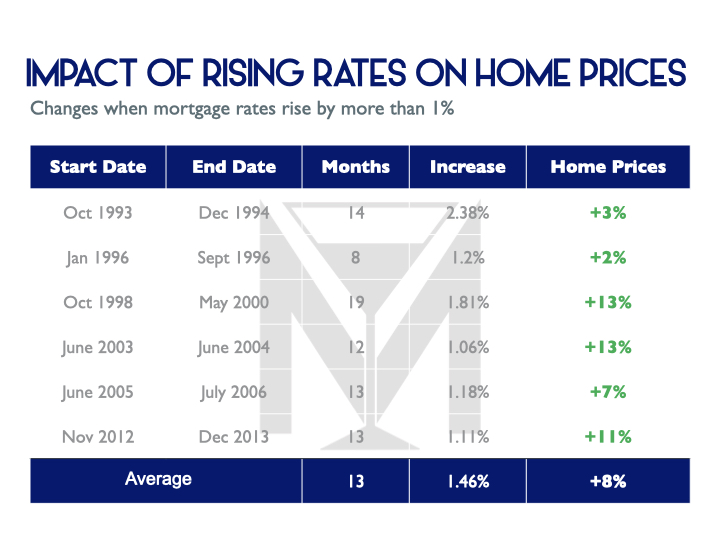

To highlight, Let us look at where we headed. Home prices are higher and Raleigh mortgage rates are higher and getting a mortgage today is a process not an event and then all the chatter from the Federal Reserve…what does it all mean for home values.

Simply put, Fannie Mae, Freddie Mac, CoreLogic, Mortgage Bankers Association, National Association of Realtors, Zellman and the Home Price Expectation Survey are the 7 entities the Martini Mortgage Group follows religiously to gauge the future of home values and the average of all 7 say that home values in 2022 will go up 9%.

Are homes going to lose value, well the experts don’t see that. Now we are going to see a deceleration of home values in 2022 as compared to 2021 however declaration does not mean depreciation. Declaration simply means that homes are not going to appreciate as fast as they have. I think deceleration is a good thing and is a sing of a healthy sustainable housing market.

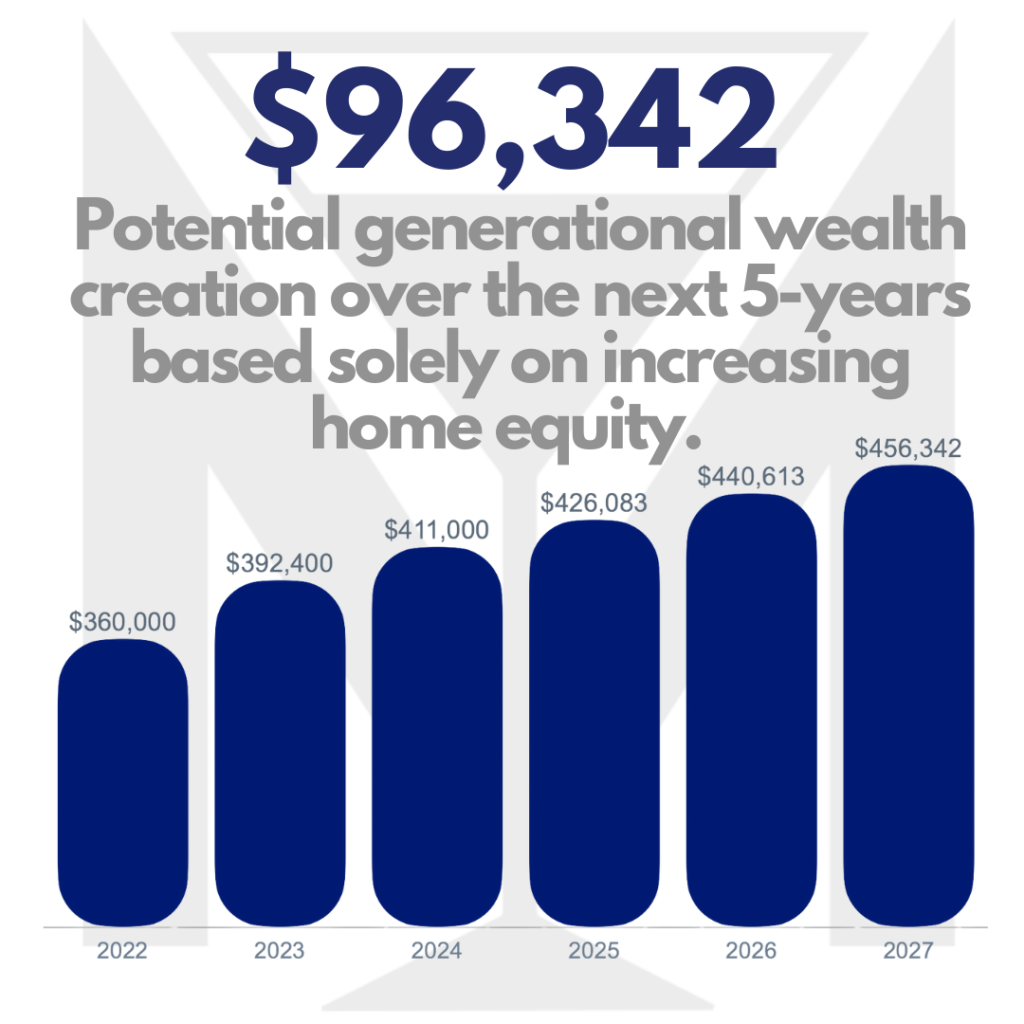

If we want to look beyond 2022 I believe the best survey to look at is the Home Price Expectation Survey which is done by Pulsenomics. The Home Price Expectation Survey is not one persons opinion it is the opinion of a panel of over 100 economists, investment strategists and housing market analysts and they project 9% appreciation this year, 4.74% next year, 3.67% appreciation in 2024, 3.41% in 2025 and 3.57% in 2026. That is a 5-year cumulative appreciation of 26.8%.

Oh by the way, 3.84% is the average annual growth in home prices from 1989 to 2019. I was purposeful not to add the last 2-years which has been north of 20% per year to give you some perspective how strong the market has been and will continue to be.

Let me wrap it up. The market today is nothing like the market was 15-years ago. I did not mention it but it is noteworthy to share there are more households today than there were in in 2007. In 2007 there were 116 million households and today there are 130 million households. That is 14 million more households looking for home. In 2007 there are 3.7 million homes for sale and today there are under 900,000 home for sale. More demand and less supply — yikes!

I know there are inventory challenges and mortgage rates have drifted upwards and sure it would have cost less if you purchased 12-months ago but I am reminded of that old Chinese proverb.

“The best time to plant a tree was 20-years ago. The second best time is now.”

Right now is the time to explore your homeownership options as a first-time or as repeat homebuyer. Perhaps you are living in your house that you own but you and your family have outgrown it— now is the time to upgrade. Perhaps you are renting and paying your landlords mortgage for them, now is time to explore your options.

My name is Kevin Martini and I am a Certified Mortgage Advisor with the Martini Mortgage Group. I provide trusted advice with a frictionless process that offers great rates and certainty to you and your family. My number is 919.238.4934.

Looking forward to connect, stay safe out there and wishing you peace and blessings.

Now it is time for the disclaimer:

This material has been prepared for marketing purposes only. This is not a loan commitment or guarantee of any kind.

Loan approval and rate are dependent upon borrower credit, collateral, financial history, and program availability at time of origination.

Rates and terms are subject to change without notice.

The Martini Mortgage Group at PCL Financial is a division of Celebrity Home Loans, NMLS # 227765 with a Branch address of 507 N Blount St Raleigh, North Carolina 27604.

You can contract Certified Mortgage Advisor and Producing Branch Manager, Kevin Martini NMLS# 143962 by calling the Branch and that number is 919.238.4934. For a full list and more licensing information please visit: www.NMLSConsumerAccess.org or by visiting www.MartiniMortgageGroup.com – Equal Housing Lender