During the first quarter of 2022 the average principal and interest payment on a $100,000 home loan went up by about $100 courtesy of rise in Raleigh home loan rates. It is expected that Raleigh mortgage rates will continue to rise in 2022 and what will the impact of higher mortgage rates be on home values in the Triangle of North Carolina?

In this special episode of the Martini Mortgage Podcast, episode 138, Certified Mortgage Advisor Kevin Martini, unpacks the data on the impact of rising mortgage rates on the housing market (e.g. appreciation and sales).

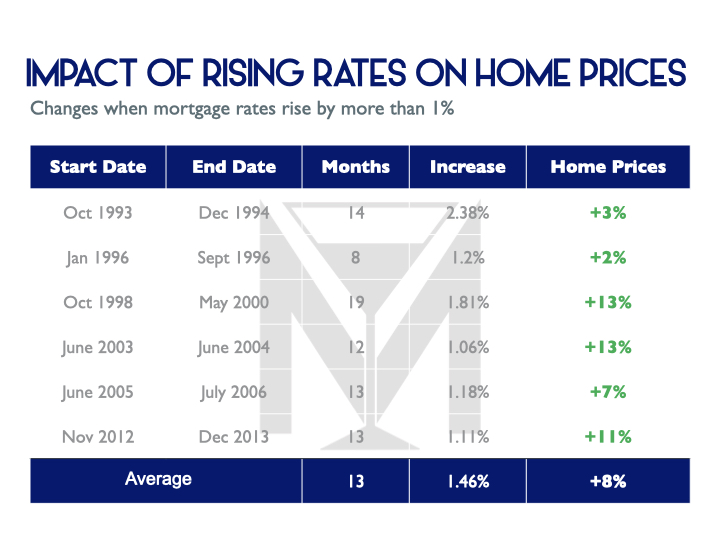

There are 6 times in recent history where mortgage rates moved more than 1%. The average increase in home loan rates during those 6 periods of time was 1.46% and the average home price increase was 8%. Historically speaking, rising home loan rates has a positive impact on home prices.

Raleigh Mortgage Lender & Certified Mortgage Advisor Kevin Martini

As discussed in episode 138 of the Martini Mortgage Podcast

Transcript of episode 138 of the Martini Mortgage Podcast with Kevin Martini

There is no question that mortgage rates today are higher than they we last week, last month or even last quarter and even last year or the year before that. In 2022, there has been an acceleration of mortgage rates, when I say acceleration, 2022 started basically right at 3% and today mortgage rates are basically at 5%. The first quarter of 2022 is not the first time that there was a significant increase in mortgage rates. How are these rising mortgage rates going to impact the housing market?

Welcome to episode 138 of the Martini Mortgage Podcast, my name is Kevin Martini, and I am a Certified Mortgage Advisor with the Martini Mortgage Group which is located in Raleigh, North Carolina however I help families in all 100 counties of North Carolina and pretty much in every state in the U.S. too. I am calling this special episode, rising mortgage rates impact on housing.

Freddie Mac publishes the Primary Mortgage Market Survey every week and they have done this since 1971. At the end of December of 2021, the 30-year fixed mortgage per their lender survey was at 3.11%. On March 31, 2022, their lender survey was at 4.67%. In the first quarter of 2022, the 30-year fixed mortgage rate increased 1.5%.

Let me get granular what that this means. The average principal and interest payment on a 30-year fixed mortgage has increased about $100.00 dollars a month per $100,000 borrowed in the first quarter of 2022. WOW, that means a $300,000 mortgage would have had a $300 a month increase in payment in the first quarter. I can understand how one would think that this rise of mortgage rates is going to impact housing negatively but is it? Will this rise in home loan rates means decline in home values in the future? Will mortgage rates keep rising at this pace? And what does it mean for housing? All great questions.

Let me tackle the future of mortgage rates. It is my opinion and the opinion of many industry experts that home loan rates will move even higher during 2022. I feel the rate of increase, no pun intended, will not be as aggressive as it has been however there are so many external factors influencing the markets that could negate that statement, specifically the Federal Reserve unwinding their balance sheet of 2.7 trillion in mortgage bonds.

You see, mortgage rates live in the Bond market as a Mortgage Backed Security. When Bond prices rise, yield is lowered and when yield is lower than mortgage rates are lower. Now when Bond prices are lower, yield rises to attract more investors. When yield rises so does home loan rates in Raleigh, North Carolina and in every state in the U.S.

The Federal Reserve purchase of these 2.9 trillion dollars of mortgage bonds started in March of 2020, and these purchases continued during the evil pandemic and this caused historic mortgage rates. It is not if the Fed will sell, it is when Fed will sell these Bonds. When they do, buckle up. The Federal Reserve decision on short term interest rates really doesn’t impact mortgage rates in the short term but in the long term, their control of short-term rates could temper inflation and when inflation is under control that is good for mortgage rates.

WOW! I went on a rant for a moment there, let me get back to the impact on rising rates on home prices. There are 6 times in recent history where mortgage rates moved more than 1%. The average increase in home loan rates during those 6 periods of time was 1.46% and the average home price increase was 8%. Historically speaking, rising home loan rates has a positive impact on home prices.

Let me break down the periods of time. Period number 1 started in October 1993 and ended in December 1994…during those 14-months the mortgage rate increased 2.38% and during that same period home prices went up 3%.

Period number 2 started in January 1996 and ended in September 1996…during those 8 months rates increased 1.2% and home prices went up 2%.

Period number 3 started in October 1998 and went on for 19 months so ending in May 2000. Home values went up 13%.

Period 4 started In June 2022 and went on for a year. Mortgage rates increased 1.06% and home values went up 13%.

Period 5 started in June of 2005 and ended in July 2006…during those 13-months, home loan rates increased 1.18% and home values went up 7%.

And in the 6th period which started in November 2012 and ended in December 2013 which was 13-months, mortgage rates increased 1.11% and home prices went up 11%.

Let me say it again, recent history has shown an increase in home values when home loan rates have increased more than 1%. I believe this recent move in home loan rates in 2022 will yield an unprecedented historic increase in home prices not just because the increase in mortgage rates but in addition to the fact we have today, low inventory levels of homes for sale. When you see headlines that say home sales are down that is because there are not enough roofs available for sale not because there is not a lot of people that need and want roof.

Let me share a Kevin Martini audio nugget with you. 2021 will go down as one of the best years in real estate history. Many people made more money with their home than they did at their job in 2021. Will 2022 be a rinse and repeat of 2021? I think so!

With that said, I do not think that home sales will be as high as they were in the past and that is not because of the lack of demand, it will be because of the lack of supply. I do believe that home appreciation will continue in 2022 and for many years to come but not at the level they had in 2021.

Let me say what I said in a different way so there is no misunderstanding. Home values are forecasted to appreciate this year and beyond for that matter in the 5-year forecast. In the April 2022 Raleigh Real Estate Report Card, it highlights that the median home price in Raleigh, North Carolina today is $395,673 and in 60-months that median priced home is expected to be over 24% higher which put sits value at $491,343. So, getting micro with the Raleigh, North Carolina real estate market, homes are expected to appreciate over 9% in 2022. Last year, in North Carolina, homes appreciated north of 21%. 2022 may not be as strong in appreciation as it was in 2021 but it is still going to be strong.

Real estate today represents a rare opportunity, and it is never to soon or too late to explore your options. You have not missed out, but you need to take steps pretty darn soon to take advantage because home values are headed upwards and so are mortgage rates.

If you have questions about what you have heard in this episode of the Martini Mortgage Podcast, I am here. If you want trusted advice with a digital mortgage process that offer a great rate with certainty check out my website by going to: www.MartiniMortgageGroup.com – you can find some real world information there and you can also securely apply online or book an appointment with me. Be sure to check out the April 2022 Raleigh Real Estate Report Card which can be found in the learning center.

Thank you for tuning in and thank you in advance for sharing this episode with someone you care about that could benefit. My name is Kevin Martini and this was episode 138 which has been called; ‘Rising mortgage rates impact on housing.”

Now it is time for the disclaimer:

This material has been prepared for marketing purposes only. This is not a loan commitment or guarantee of any kind. Loan approval and rate are dependent upon borrower credit, collateral, financial history, and program availability at time of origination. Rates and terms are subject to change without notice. The Martini Mortgage Group at PCL Financial is a division of Celebrity Home Loans, NMLS # 227765 with a Branch address of 507 N Blount St Raleigh, North Carolina 27604. You can contract Certified Mortgage Advisor and Producing Branch Manager, Kevin Martini NMLS# 143962 by calling the Branch and that number is 919.238.4934. For a full list and more licensing information please visit: www.NMLSConsumerAccess.org or by visiting www.MartiniMortgageGroup.com – Equal Housing Lender