Are you among the many future and current homebuyers, excited with the prospect of purchasing a new property? While it’s certainly an exciting time for anyone, regardless of your experience level, it’s important to be educated about all aspects of becoming a homeowner – including understanding the potential of substantial tax benefits to owning a home and having a mortgage.

Did you know that homeowners that itemize tax deduction can deduct interest on an up to $750,000 of mortgage balances used to buy, build or improve a qualified home (see IRS Publication 936)?

With the mortgage interest tax deduction, the cost of borrowing may be lower than you think!

Kevin Martini

Most homebuyers and some current homeowners don’t understand and are surprised that their cost of borrowing is significantly reduced by this tax benefit.

As discussed, homeowners who itemize tax deductions can deduct the interest on up to $750,000 of mortgage balances used to buy, build or improve a qualified home. In the past few years, not as many homebuyers benefited from this because their total annual interest expense was lower than their standard deduction. In 2023, for married couples filing jointly for tax year 2023 the standard deduction will be $27,700. For single taxpayers and married individuals filing separately, the standard deduction is $13,850 for 2023

IMPORTANT: Uncle Sam will never help you pay your rent however he will help you pay your mortgage vis-à-vis Home Mortgage Interest Deduction however to take advantage you must itemize your taxes not take the standard deduction.

The Kevin Martini 3 Step Process to Calculate Impact of Home Mortgage Interest Deduction

- Determine Marginal Tax Rate

- Know Mortgage Rate

- Very Simple After-Tax Benefit Math

Determine Marginal Tax Rate

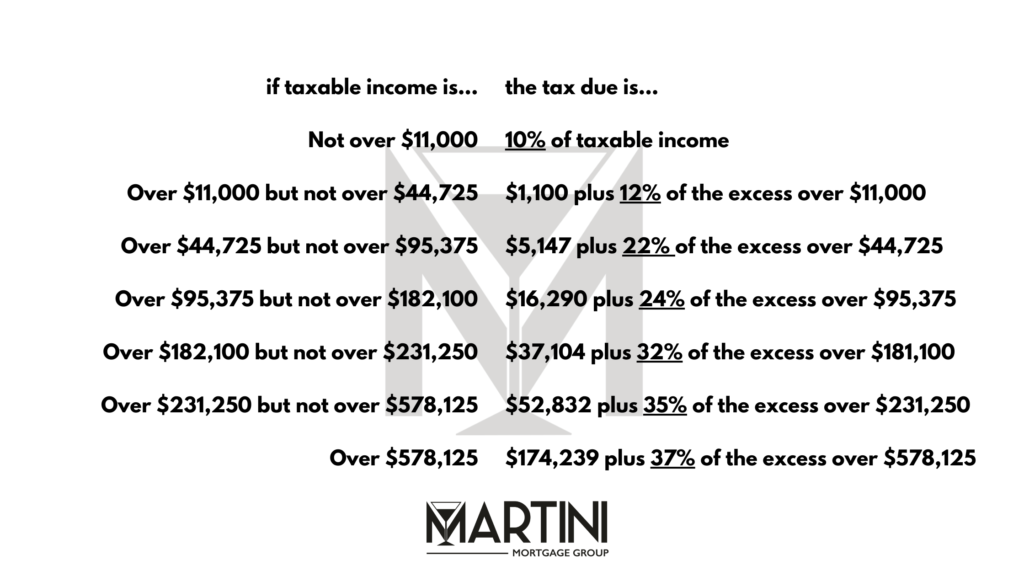

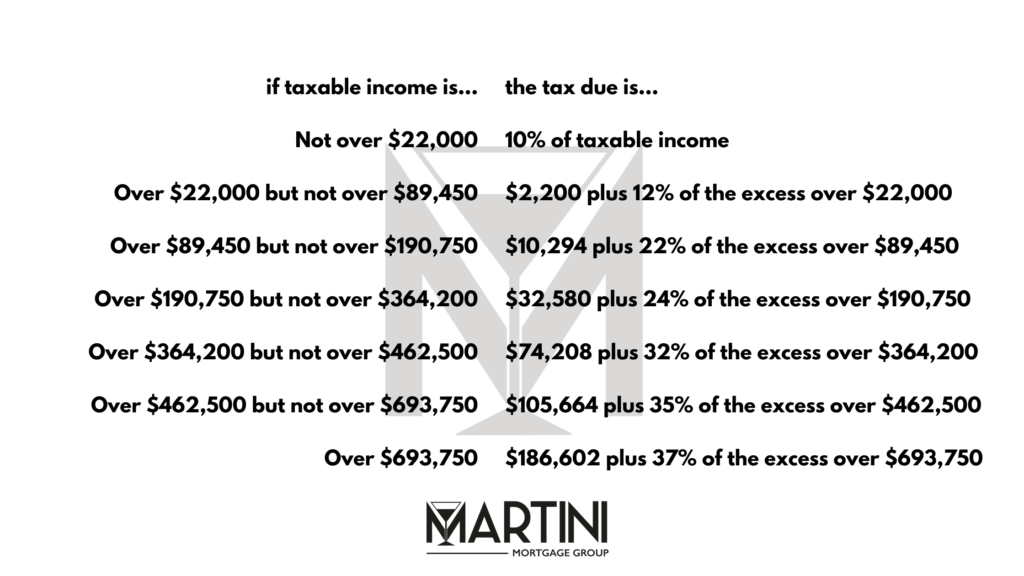

What is your marginal tax bracket? A marginal tax rate is the rate that applies to your last dollar of taxable income. In other words, the highest bracket homebuyer’s income falls into. At the time of publication, there are seven federal income tax brackets (i.e. 10%, 12%, 22%, 24%, 32%, 35% and 37%). Determine which bracket you are in based on how you file (i.e. a single filer or married filing jointly).

2023 Single Filers Tax Bracket (for illustration only)

2023 Married Filing Jointly Tax Brackets (for illustration only)

Know Your Mortgage Rate

You need to know what your mortgage rate is not you Annual Percentage Rate (APR).

Very Simple ‘After-Tax Benefit’ Math

This step is very simple but does have 3 components

#1 Express the tax bracket as decimal

#1 Express the tax bracket as decimal … for illustration and example ONLY, let’s assume a 24% marginal tax bracket so in decimal form that is expressed as 0.24

#2 Subtract the decimal from the whole number one

#2 Subtract the decimal from the whole number one … for illustration and example ONLY, we would take one minus the marginal tax bracket expressed as a decimal hence, 1 – 0.24 = 0.76

#3 Multiple that number by the the current or actual mortgage rate

#3 Multiple that number by the the current or actual mortgage rate … for illustration and example ONLY. let’s use a mortgage rate of 6.5% so 6.5 x 0.76 = 4.94

In the example above, your mortgage rate is 6.5% and your are in a 24% tax bracket then your after-tax rate in 4.94% assuming that you itemize your taxes. That means, the Home Mortgage Interest Deduction saves you 1.56%!

While there are many exciting aspects to purchasing a new home, it is important to be educate about all aspects of becoming a homeowner – including understanding the potential of substantial tax benefits to owning a home and having a mortgage. With the mortgage interest tax deduction, the cost of borrowing may be lower than you think! If you’re considering homeownership, connect with either Kevin Martini or Logan Martini today so we can help you take advantage of this amazing opportunity.

Kevin Martini

Certified Mortgage Advisor | NMLS # 143962

Martini Mortgage Group at Gold Star Mortgage Financial Group, Corporation | NMLS # 3446 | 507 N Blount St, Raleigh, NC 27604 | (919) 238-4934 | www.MartiniMortgageGroup.com | Kevin@MartiniMortgageGroup.com | Equal Housing Lender

Logan Martini

Senior Mortgage Strategist | NMLS #1591485

Martini Mortgage Group at Gold Star Mortgage Financial Group, Corporation | NMLS # 3446 | 507 N Blount St, Raleigh, NC 27604 | (919) 238-4934 | www.MartiniMortgageGroup.com | Logan@MartiniMortgageGroup.com | Equal Housing Lender

PLEASE NOTE: THIS ARTICLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE LEGAL, TAX, OR FINANCIAL ADVICE. PLEASE CONSULT WITH A QUALIFIED TAX ADVISOR FOR SPECIFIC ADVICE PERTAINING TO YOUR SITUATION. FOR MORE INFORMATION ON ANY OF THESE ITEMS, PLEASE REFERENCE IRS PUBLICATION 936. Also, this article is not an offer or commitment to lend you money, and it is not an advertisement for a specific mortgage or a specific interest ratehttp://2023 Raleigh Conforming Loan Limits

Related Articles:

How Does The Gift Tax Work When Using Gift Funds To Buy A Home By Raleigh Mortgage Broker Kevin Martini

What You Need To Do Before Buying a Home in Raleigh

2023 Raleigh Conforming Loan Limits

Related Podcasts: