Are you a homebuyer looking to buy your first house in the Raleigh, NC area?

If so, then you may have heard about FHA Home Loans and the potential benefits of them. But what exactly are FHA Home Loans and how do they work? As an experienced mortgage broker in the Raleigh area for more than 15 years, this article has been curated to answer all your questions about this popular loan program.

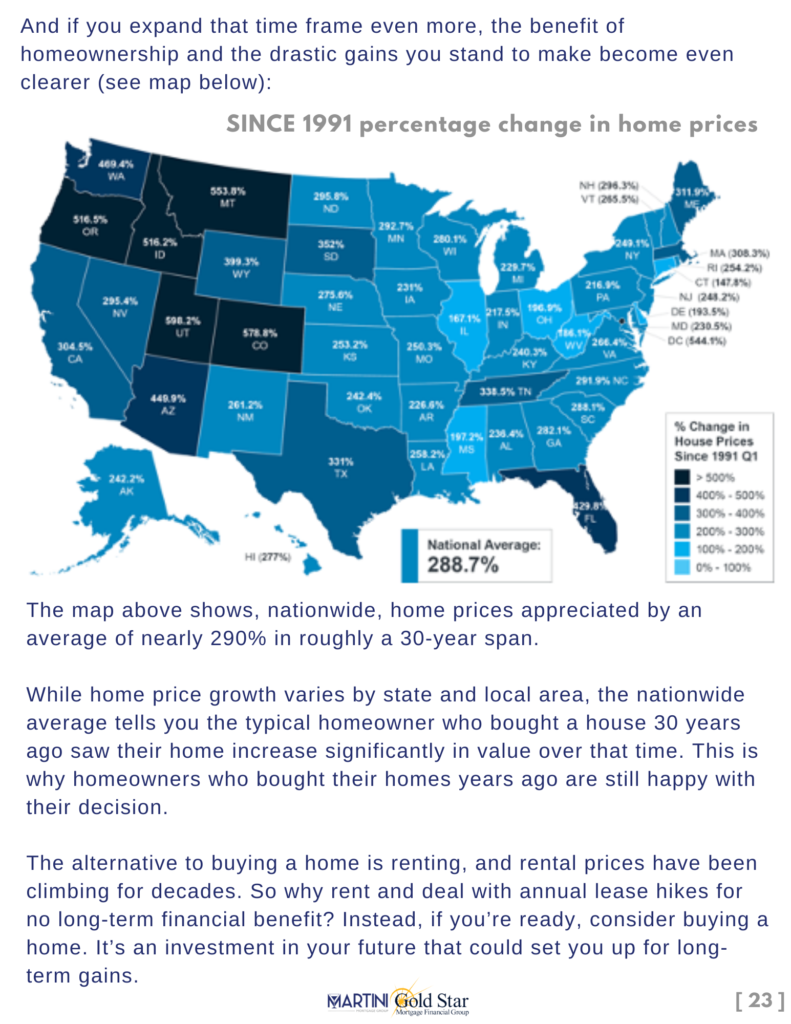

In this article, I will share a glimpse of what you need to know about FHA loans including who can apply for one and some of their advantages both financially and long-term. I truly believe, armed with knowledge on FHA Home Loans from my helpful explanations, you’ll be able to make educated decisions that could potentially save you thousands of dollars over time and help you create generational wealth with the proper mortgage strategy.

What is a FHA Home Loan?

FHA Home Loans are a type of mortgage loan that is insured by the Federal Housing Administration (FHA). This government-backed insurance is designed to help qualified borrowers get into a home easier and with less money down. FHA loans do not require a high credit score and offers a lower down payment requirement than more traditional mortgage loans, making them an ideal choice for first-time homebuyers and repeat homebuyers too!

FHA loans are also incredibly flexible, as they can be used to purchase a wide variety of properties from single-family homes to townhomes and much more.

Advantages of FHA Home Loan with Kevin Martini

In terms of advantages that come with choosing FHA Home Loans, the most notable one is their low down payment option.

With FHA Home Loans, borrowers only need to put down 3.5% of the total purchase price as a down payment. This amount is significantly lower than what is typically required for more traditional mortgage loans and can be attained with a variety of financial sources such as gifts from family or funds from your local housing agency.

Another advantage of FHA Home Loans is that they are assumable, meaning that if you eventually decide to sell your home, a qualified buyer can assume the balance of the loan without having to go through the entire approval process again. This makes it easier for buyers and sellers alike, especially in today’s highly competitive housing market.

Things to know about the FHA Home Loan

It’s important to note, however, that FHA Home Loans do come with certain restrictions and requirements. The most notable of these is the Mortgage Insurance Premium (MIP). All FHA Home Loans require borrowers to pay an annual MIP in order to keep their loan in good standing. This does add an additional cost on top of the loan itself, but it’s important to remember that the MIP is what allows borrowers with lower credit scores and higher debt-to-income ratios to qualify for a loan in the first place.

Although there is no income limit with FHA Home Loans, the borrower must still demonstrate an ability to repay the loan. This means that having a steady job and verifiable income are important for obtaining approval.

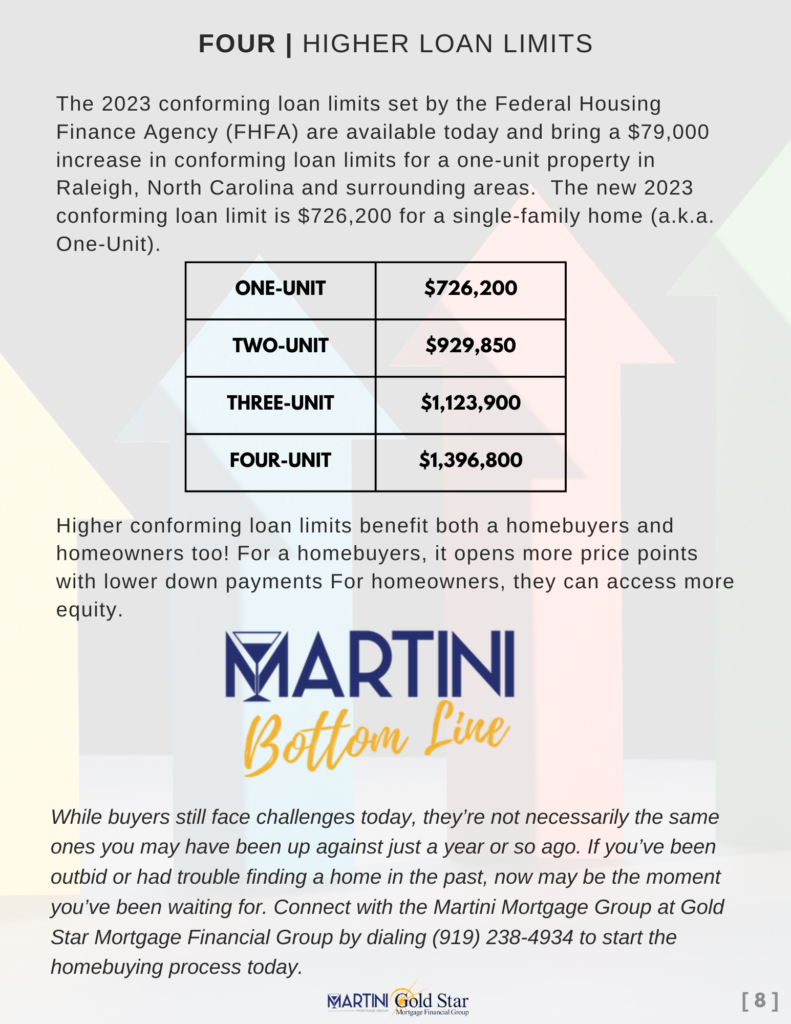

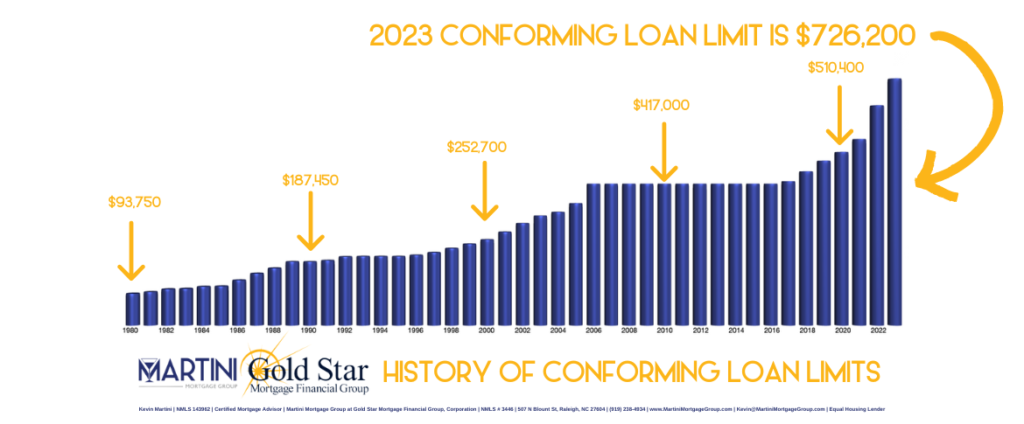

Additionally, the property must be appraised by an FHA-Additionally, there is a loan limit in place which varies depending on the particular county and/or area of the country. In Wake County and Raleigh, NC, the loan limit for a one-family with a FHA Home Loan in 2023 is $502,550.

As you can see, there are a few things to consider when it comes to FHA Home Loans. Myself and the entire Martini Mortgage Group can help you navigate the process, so don’t hesitate to get in touch if you have any questions or would like to start the application process. Together we can find a solution that’s best for you and get you into your dream home as quickly and easily as possible.

The Kevin Martini Bottom Line

Now that you know more about FHA Home Loans and their potential benefits, it’s time to start your mortgage journey! If you’re ready to take the next step, contact me today so we can discuss your options and help you find the perfect home loan for your unique situation. With my trusted advice and expertise in the Raleigh mortgage market, I’m confident that you’ll be able to make an informed decision on which loan program is right for you.