Private Mortgage Insurance (a.k.a. PMI) is a good thing! In special episode 137 of the Martini Mortgage Podcast, Certified Mortgage Advisor Kevin Martini shares 5 Benefits of Private Mortgage Insurance.

There are many myths associate with getting a mortgage. Some of the myths are relating to credit score need to get a home loan and many myths are associated with the amount of down payment needed to secure a mortgage. One does not need to have perfect credit to buy a home nor do they have to have a 20% down payment to secure a mortgage.

Private mortgage insurance provides a competitive edge to borrowers today because it helps more people afford homeownership.

Raleigh Mortgage Lender & Certified Mortgage Advisor Kevin Martini

5 Benefits of Private Mortgage Insurance

There are more than 5 Benefits of Private Mortgage Insurance however on 5 are shared by Kevin Martini in episode 137 of the Martini Mortgage Podcast are:

Benefit 1 of Private Mortgage Insurance is:

Private mortgage insurance allows one to buy a home sooner and earn more equity with a lower down payment.

Benefit 2 of Private Mortgage Insurance is:

Private mortgage insurance provides expanded cash-flow.

Benefit 3 of Private Mortgage Insurance is:

Private mortgage insurance provides the ability to buy first and then sell.

Benefit 4 of Private Mortgage Insurance is:

Private mortgage insurance helps overcome appraisal issues.

Benefit 5 of Private Mortgage Insurance is:

Private mortgage insurance provides the ability to afford homes in higher price points.

Many people believe the myth that they have to have perfect credit and a 20% down payment to secure a mortgage home loan today. Perfect credit and 20% down payment is a widely held but false belief. Another misconception is that private mortgage insurance is a bad thing, this to is a misconception. Private mortgage insurance is a good thing and access to private mortgage insurance is not reserved for first-time homebuyers only. It is time to rethink private mortgage insurance because it is a tool to help more people become homeowners.

Welcome to episode 137 of the Martini Mortgage Podcast, my name is Kevin Martini and I am a Certified Mortgage Advisor with the Martini Mortgage Group which is located in Raleigh, North Carolina however I help families in all 100 counties of North Carolina and pretty much in ever state in the U.S. too. I am calling this special episode, 5 benefits of private mortgage insurance.

Before I start to dig into the 5 Benefits of Private Mortgage Insurance, know that private mortgage insurance is also known as PMI, mortgage insurance, MI or private MI. Whatever one calls it is, PMI is a guaranty that reduces the loss to lender in the event a borrower doesn’t repay their mortgage. Let me share an audio 30,000 feet example for illustration on how PMI works.

Let us assume a borrower is buying a $200,000 home with a fixed rate mortgage and they are putting 10% down, hence a $180,000 mortgage. With a 90% loan-to-value on a fixed rate mortgage 25% coverage is required for most conventional home loans. In other words, the mortgage insurer is covering 25% of the loan amount or responsible for paying 25% of the outstanding loan balance in the event of default which leaves the lender risk at 67.5%. If there was no PMI, the lender would have all the risks. Because of the coverage protection PMI offers lenders, PMI creates an opportunity for borrowers to buy with less than 20% down.

Now to the 5 Kevin Martini Benefits of Private Mortgage Insurance.

Number one is, private mortgage insurance allows one to buy a home sooner and earn more equity with a lower down payment. Let me explain with a story…

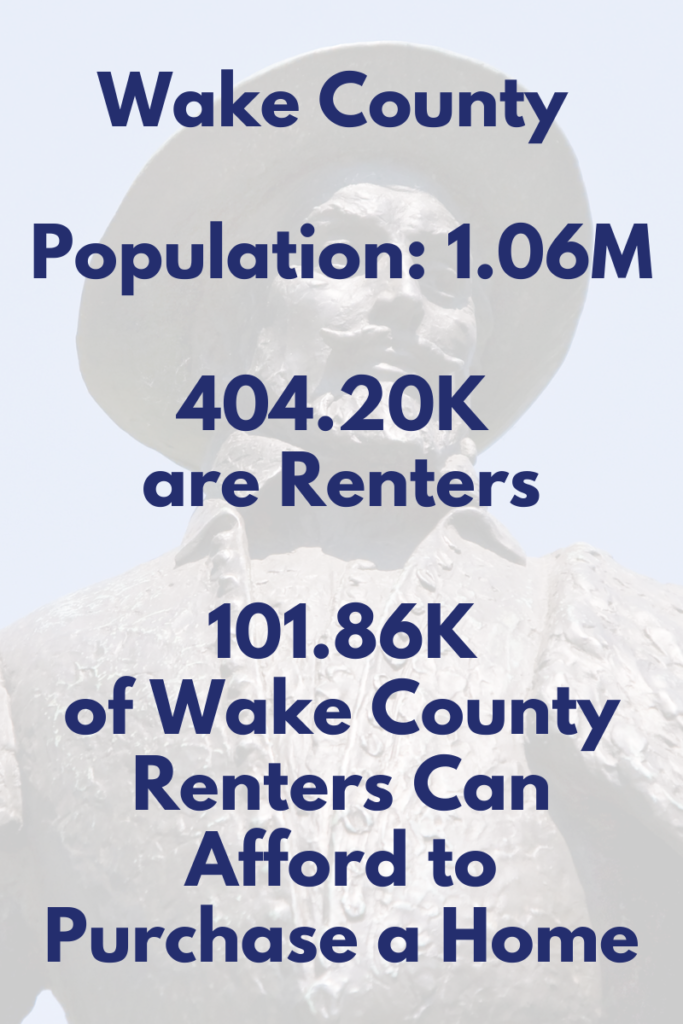

Walter is renting in Raleigh and he has a good job with a little money saved up however Walter does not know if you should keep renting or if he should buy a home. Let us assume that Walter has $10,000 saved up however his folks think he should hold off on buying until he can save more money for a 20% down payment. Should Walter explore his homeownership options now or should he keep renting until he has the 20% saved up?

Before I move on, as a Certified Mortgage Advisor I provide a human touch to the families I serve, I assess the full financial picture, understand future goals and design a mortgage product that meets needs if homeownership is right strategy. I share this because homeownership is not right for everyone and that is OK. If it is right for you and your family, taking action sooner than later is smart.

Let us assume that I have accessed that homeownership is right for Walter. Here are some factual nuggets I would share with him.

I would share that home prices and mortgage rates could rise and this increase would make his eventual purchase more expensive.

I would share that the rent he pays will not build him any equity and I would highlight rents are rising every year.

I would share that there are home loan products offered by the Martini Mortgage Group that only require 3% down payment.

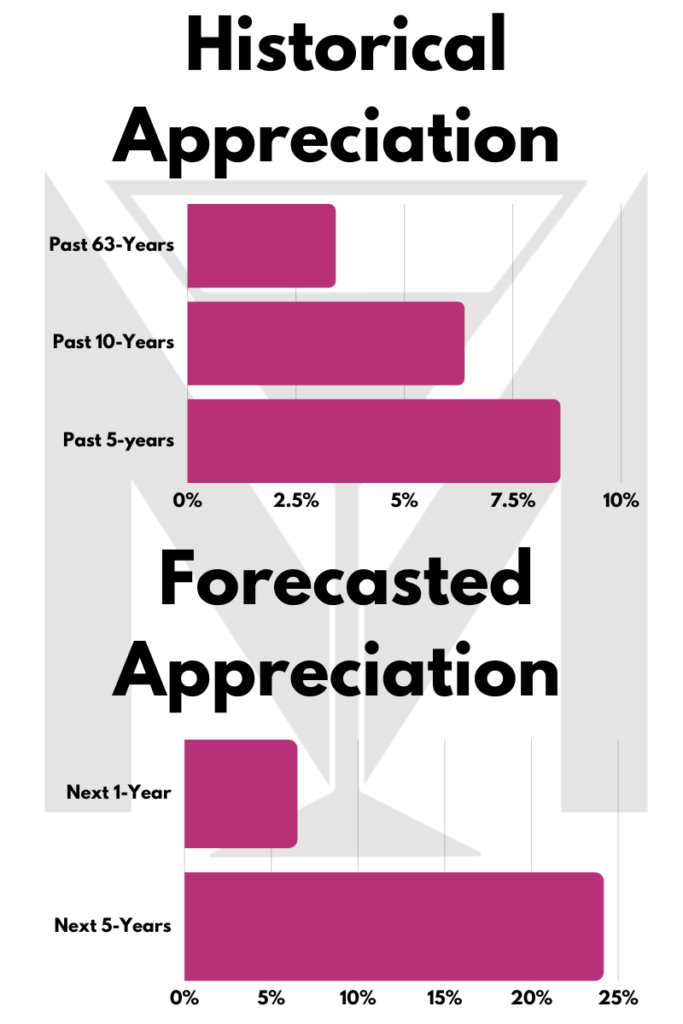

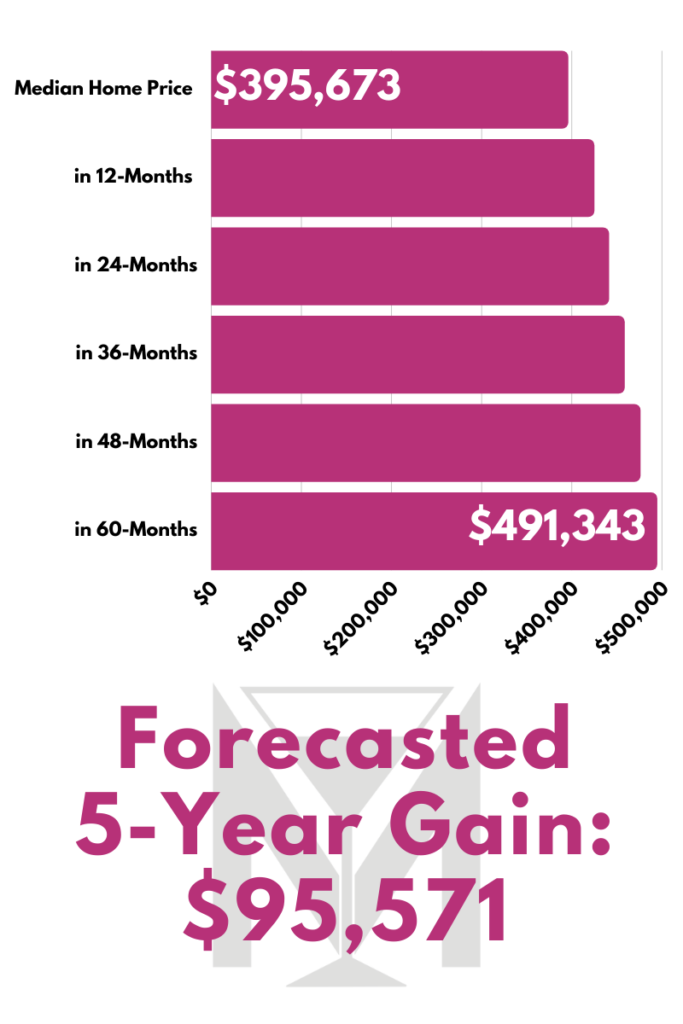

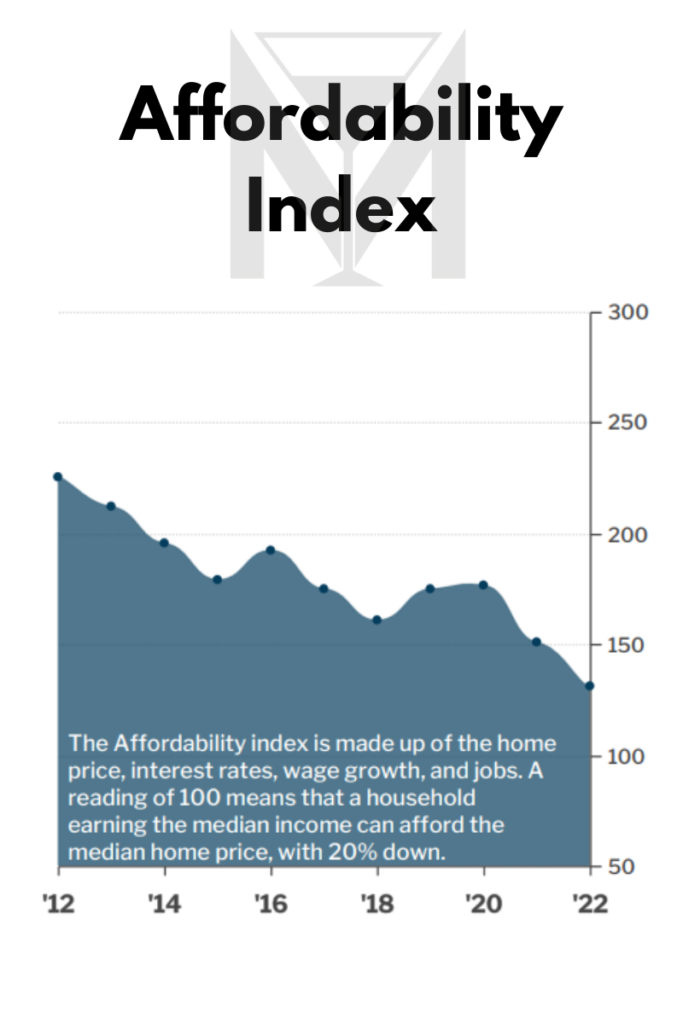

I would also highlight the cost of waiting…in other words, it would likely take 5 to 7-years for Walter to come up with a 20% down payment based on his current savings. According to the April 2022 Raleigh Real Estate Report Card, the median home price is $395,763 and the appreciation forecast for the next 12-months is 6.94% and for the next 60-months homes in Raleigh area are expected to have a cumulative appreciate of 24.15%. This means waiting for 5-years to save for the 20% down payment would cost $95,571. Oh by the way, who knows where mortgage rates will be in 5-years from now. We know that today, home loans rates today are not as low as they have been however they are still at historic levels.

Private mortgage insurance would allow Walter to buy a home sooner and earn more equity with his under 20% down payment he has today.

Number two of five Kevin Martini Benefits of Private Mortgage Insurance is Expanded Cash Flow.

Remember that PMI is not an exclusive benefit for only first-time home buyers, repeat home buyers have access to private mortgage insurance too! There is nowhere that it says you have to go from small home to medium house before you can afford your dream home. Putting less down can be more.

Let me share a real-world family that I helped. This family has 2 young kids plus one on the way. They simply outgrew their current house, and they needed a bigger home to accommodate their growning family. They had enough for a 20% down payment but with their day care expenses were getting ready to explode plus having knowledge of their future plans they had which I learned during our mortgage strategy session, I developed a lower down payment financing solution. family. The elected to go with a 5% down option and saved 63,750 of cash…yes, their payment went up but it would have taken them 12-years to re-save that 67,750. Plus since they were already in their home for over 2-years, that 63,750 was tax free and this mortgage strategy expanded their cash-flow. Oh by the way, private mortgage insurance is not required to be on the loan forever. There is a point that PMI can fall off the loan and that will be an opportunity for a lower payment without refinancing.

Number three of five Kevin Martini Benefits of Private Mortgage Insurance provides the ability to buying first & then selling. Sometimes one needs to buy first and then sell however…they qualify from a debt-to-income perspective but the do not have a large down payment. Take a look at the family I just talked about…they both work and they have 2 kids and one on the way, they did not have time to properly stage their house for sale nor did they have the ability to keep the house model home condition but they did have some liquid cash plus some monies in their 401K plus they qualified with 2 mortgages.

Here is what I did, they put 5% down…some came from cash on hand and they took a loan from their 401k. They purchased the home using PMI and once their home sold, they paid back the 401K loan and had the extra cash they needed too. The other benefit with this strategy is they knew they would never be homeless and they had time to find their dream home because they already had a roof over their head and no pressure to find a home by a specific date.

Number four of five Kevin Martini Benefits of Private Mortgage Insurance it helps overcome appraisal issues.

As you know, at the time of this recording we are in a very hot real estate market,. I had a client that finally had her bid accepted on the perfect place for her to call home. The listing price was $380,000 but she offered $400,000 to be competitive. She had a plan put 20% down but sadly there was an appraisal gap. The home appraised at 380,000. Now she did not have the ability to put the 20% down and cover the appraisal gap. I developed a strategy using private mortgage insurance where her payment actually became exactly the same with 15% down as compared to what they originally expected thanks to the help of PMI. Yes, this was an advanced strategy used as a Certified Mortgage Advisor and she was able to reap the reward of my extensive training and on-going continuing education to provide cutting edge home loan solutions and get her into her dream home.

Finally, Number five of five Kevin Martini Benefits of Private Mortgage Insurance is PMI provides the ability to afford homes in higher price points. Simply put, PMI helps you expand your house hunting options. . PMI will help you break into new neighborhoods and new price points.

Let me get real, it takes time and hard work to save money. Let us assume that you have saved 15,000. For simple illustration you would have 3 options.

Option number one would be buy a home for $75,000 and put 20% down or explore the other 2 options that include the use of private mortgage insurance to amplify your buying power. With that said let me share option number 2…you double the purchase price to $150,000 and put 10% down or you 4X your purchase price to $300,000 and put 5% down.

I am not a real estate agent however I know there is a material difference between a $75,000 home to a $150,000 home and there is a quantum leap from a $75,000 home to a $300,000. Assuming, of course, that they can afford the higher monthly payment that accompanies the larger home price then when using PMI you are offered increased buying power and expand their home search, allowing yourself and your family to consider a wider range of home prices and available homes for sale.

WOW, that was a lot wasn’t it? In closing let me share this with you. Private mortgage insurance is there for you when you want it or need it and it is not there when you don’t need it. PMI can usually be canceled when the loan either reaches the cancellation point due to amortization of the original loan amount, or the borrowers request cancellation based on an increase in their home value due to appreciation or home improvements.

If you have questions about private mortgage insurance or about how PMI can help you and your family, I am here. If you want trusted advice with a digital mortgage process that offer a great rate with certainty check out my website by going to: www.MartiniMortgageGroup.com – you can find some real world information there and you can also securely apply online or book an appointment with me. Be sure to check out the April 2022 Raleigh Real Estate Report Card which can be found in the learning center.

Thank you for tuning in and thank you in advance for sharing this episode with someone you care about that could benefit. My name is Kevin Martini and this was episode 137 which has been called; ‘5 benefits of private mortgage insurance

Now it is time for the disclaimer:

This material has been prepared for marketing purposes only. This is not a loan commitment or guarantee of any kind. Loan approval and rate are dependent upon borrower credit, collateral, financial history, and program availability at time of origination. Rates and terms are subject to change without notice. The Martini Mortgage Group at PCL Financial is a division of Celebrity Home Loans, NMLS # 227765 with a Branch address of 507 N Blount St Raleigh, North Carolina 27604. You can contract Certified Mortgage Advisor and Producing Branch Manager, Kevin Martini NMLS# 143962 by calling the Branch and that number is 919.238.4934. For a full list and more licensing information please visit: www.NMLSConsumerAccess.org or by visiting www.MartiniMortgageGroup.com – Equal Housing Lender